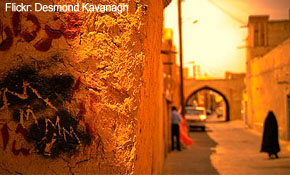

You and I fret over how to balance our investment dollars in a SEP or an IRA. Meanwhile, Robert P. Smith has his bags packed for Damascus, Syria to measure that country’s investment potential. That’s why he is portrayed as the “Indiana Jones” of international finance.

You and I fret over how to balance our investment dollars in a SEP or an IRA. Meanwhile, Robert P. Smith has his bags packed for Damascus, Syria to measure that country’s investment potential. That’s why he is portrayed as the “Indiana Jones” of international finance.

“Give me a country that is at war because the last President has been shot and I’ll figure out something to do to make money,” says Smith who is author of RICHES AMONG THE RUINS—Adventures in the Dark Corners of the Global Economy.

In this new book, Smith recounts his experiences risking not only his money, but his life, in war zones, dictatorships, and crime-ridden capitals in countries like El Salvador, Nigeria, Turkey, Russia and Iraq.

Smith sounds like he has a risky life, risking not only his investments but his life. But he doesn’t see it that way. He says he is risk adverse which he defines as always having an exit strategy for most of the bonds he invests in. He suggests that any time you invest in something that looks like it’s going bad, you should head to the exit. You’re better off taking a loss and living to fight another day.

For Smith that strategy has served him well except when it came to Russia. He rationalized that Russia was too big for the World Bank and International Monetary Fund to let fail. In turn, he invested $20 million in Russian Government Bonds. But then on August 17, 1998 Smith says, “Russia gave the middle finger to the financial world and I was at the top of the finger.”

That lesson taught him to never bet on something just because it seems “too big to fail.” He contends that nothing—no company, business or country—is immune to failure. As examples in the United States he cites General Motors, AIG, Fannie Mae and Freddie Mac.

The first thing Smith will do when arriving in Damacus will be to try to identify a local partner he can trust. To find that person who can provide him with local insights he talks with everyone including the cab driver on the ride from the airport. But he says you need to be careful because resumes are more fraudulent today.

The countries that Smith predicts will be the rising stars for investors are Brazil, China, India and Russia in that order. He suggests if you’re buying a mutual fund you should look to see if those countries are included.

You can follow Smith’s thinking at www.richesamongtheruins.com

Article By Paul J. Welsh

Interview conducted by Jay Liebenguth

Leave a Reply